1 Minutes Delivery

1 Revisions

Beauty Devices Market Outlook: Innovation, Clinical Trust & Market Expansion (2024–2032)

Address

Pune, MaharashtraAbout This Gig

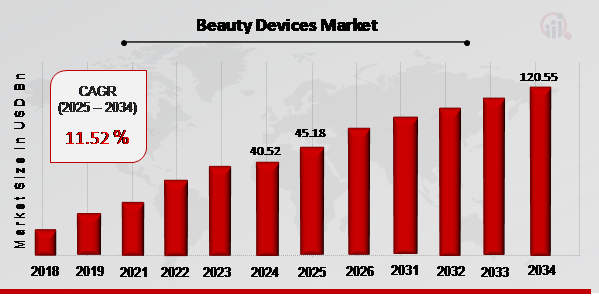

The global beauty devices market—spanning facial cleansing systems, microcurrent tools, radiofrequency (RF) platforms, LED and laser devices, and home-use microdermabrasion units—is experiencing steady growth. Valued at roughly USD 8.5 billion in 2023, it's projected to reach USD 9.3 billion in 2024, and expand to USD 15.2 billion by 2032, reflecting a compound annual growth rate (CAGR) of around 7.0%. This momentum is being propelled by rising consumer preference for non-invasive treatments, advances in home-use technology, and a growing spa and clinic infrastructure worldwide. https://www.marketresearchfuture.com/reports/beauty-devices-market-562 For device OEMs, spa and dermatology practices, distributors, and investors, the market presents opportunities to scale by combining product innovation, clinic integration, and service-driven approaches. Market Growth Drivers 1. Rise in Non-Invasive Aesthetic Treatments Consumers increasingly prefer beauty solutions with minimal downtime. Devices offering microcurrent skin toning, handheld RF for tightening, and LED-based rejuvenation address this demand. Clinics are benefiting from in-office uptake, while home-quality platforms are enhancing consumer accessibility. 2. Emergence of Home-Use Beauty Tech Technological miniaturization and safe energy sources have led to a wave of FDA-cleared home devices. Skincare routines now include at-home LED masks, cleansing brushes, and sonic wands. These devices fuel recurring revenue through consumables like serums and replacement heads. 3. Increased Adoption in Professional Clinics and Spas Dermatology practices, medical spas, and aesthetic clinics are outfitting treatment rooms with advanced laser-systems, fractional RF, and microdermabrasion tools. Bundled service models—integrating consultation, package plans, and maintenance programs—help clinics differentiate and build recurring-income services. 4. Tech Advancements & Data Integration Next-gen beauty devices weave data analytics and skin-scanning features into treatment systems. Connected platforms track progress, monitor routines, and support remote expert oversight. These data-centric tools provide stronger efficacy proof points, supporting professional care recommendations. 5. Growth in Medtech‑Spa Integration Collaborations between device OEMs and professional clinics—offering licensed devices, training, and maintenance programs—are becoming standard. These partnerships help clinics deliver results aligned with pharmaceutical-grade standards, strengthening consumer trust. Market Segmentation Overview By Product Type Microcurrent and Sonic Cleansing Devices Radiofrequency, Ultrasound, and LED Light Platforms Fractional Laser & IPL Systems Microdermabrasion & Dermaplaning Tools By Setting Professional Systems (clinics, dermatologists, med-spas) Home-Use Devices (consumer-grade electronics) By Application Facial Rejuvenation and Skin Tightening Hair Removal & Pigmentation Treatment Acne Management & Scar Reduction Anti-Aging and Wrinkle Reduction By Distribution Channel Clinic-Based Sales & Leases Retail & E-commerce Direct Wholesale to Spas and OEM Partners By Region North America & Europe: Large clinic penetration and spa adoption Asia-Pacific: Fastest growth—driven by rising disposable income and beauty tourism Latin America & MEA: Emerging markets investing in spa infrastructure Competitive Landscape The beauty devices market is comprised of: Large OEMs: Provide professional-grade lasers, RF systems, and integrated treatment platforms. Start-Ups: Agile players offering niche skincare tools with data analytics and unique energy modalities. Beauty Tech Brands: Large personal care companies launching consumer-level devices as part of multi-channel strategies. Channel Providers: Distributors offering bundled training, service packages, and clinic-ready systems. Successful providers balance device performance with clinical outcomes, maintenance support, consumables, and educational services. Opportunities for B2B Stakeholders Integrate Clinical Training Programs Offer certified training for practitioners pairing device sale with educational support. This helps clinics boost credibility, increase treatment packages, and deliver consistent resultsAbout The Seller

Pharma24

26-Jun-2025

Compare Packages

| Package |

€400 000 Basic |

€500 000 Standard |

€600 000 Premium |

|---|---|---|---|

| Basic | Standard | Premium | |

| Revisions | 1 | 1 | 1 |

| Delivery Time |

|

|

|

| Total |